Congress has passed the first overhaul of the U.S. tax code in more than 30 years. The Tax Cuts Act is a powerful symbol of what Republicans can accomplish when they unite behind a positive governing agenda for the country.

But this legislation isn’t about Republicans vs. Democrats. Rather, it’s an early centerpiece of the vision President Trump laid out on the campaign trail. Americans of all backgrounds want a government that’s more accountable, more democratic, and less eager to line its pockets with cash from taxpayers and small businesses.

Returning money from Washington to the people is the clearest sign our leaders can give that they take this responsibility seriously.

![]()

The U.S. tax code was an overcomplicated mess, so we understand Americans want to know exactly what’s different under the new law. It makes three important changes to our tax system:

The U.S. tax code was an overcomplicated mess, so we understand Americans want to know exactly what’s different under the new law. It makes three important changes to our tax system:

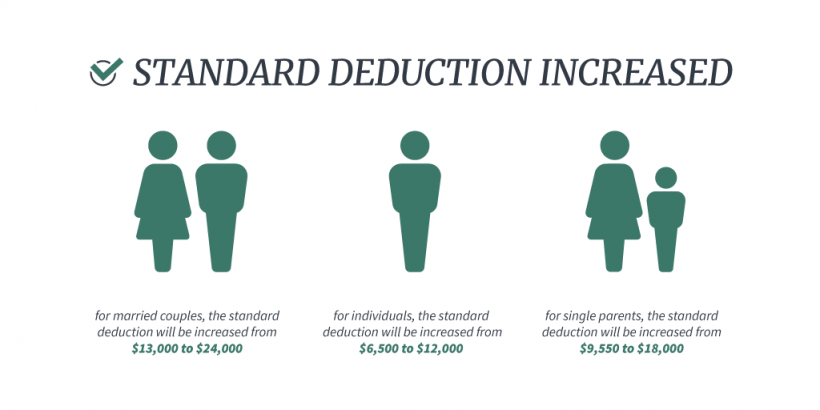

- The Tax Cuts Act means less money taken out of Americans’ paychecks. It provides $5.5 trillion in tax cuts by nearly doubling the standard deduction, doubling the child tax credit, protecting tax savings for higher education and retirement, and lowering rates across the board. It also repeals Obamacare’s individual mandate tax, 80 percent of which hit households earning less than $50,000 a year in 2016.

- The bill puts American businesses on a level playing field with foreign competitors. America’s corporate tax rate will go from being the highest in the developed world to below the average for Organisation of Economic Co-operation and Development (OECD) countries. A one-time tax on corporate earnings stashed overseas will end the incentive for companies to keep their profits outside of the United States.

- The act will eliminate dozens of special interest tax breaks and loopholes. The Tax Cuts Act will raise $4 trillion in revenue to help offset tax cuts by closing the door on dozens of corporate accounting tricks. The bill eliminates a loophole used to deduct compensation for executives earning more than $1 million a year. Washington isn’t spared, either: Members of Congress will no longer be able to deduct their living expenses.

Talk is cheap, of course—the proof will come when Americans begin seeing more money in their paychecks as early as February.

In addition to tax relief for working families, this bill is about restoring America’s economic dominance. While excessive business taxes are unseen by many, everyone feels the effects through higher prices and lower wages. By flattening the tax rate for American companies across the board, all businesses—not just the well-connected ones that pay for teams of lawyers and accountants—will be able to invest once more in our country’s future.

“This is going to mean companies are going to be coming back,” President Donald J. Trump said before members of Congress on the White House’s South Lawn. “You know, I campaigned on the fact that we’re not going to lose our companies anymore.”

With the U.S. stock market breaking record highs no fewer than 70 times in 2017, that project of American renewal is off to a great start.