Today, the Bureau of Economic Analysis released its advance estimate for United States GDP for the fourth quarter of 2019 and the entire calendar year of 2019. The release estimates that real GDP grew 2.1 percent at an annual rate in the fourth quarter of 2019 and 2.3 percent over the four quarters of 2019. Consumer spending and residential investment posted notable gains, propelling GDP growth and setting the stage for future economic expansion. These results show that the economy remains resilient despite a slowdown across the rest of the world and the continuation of the longest expansion in American history.

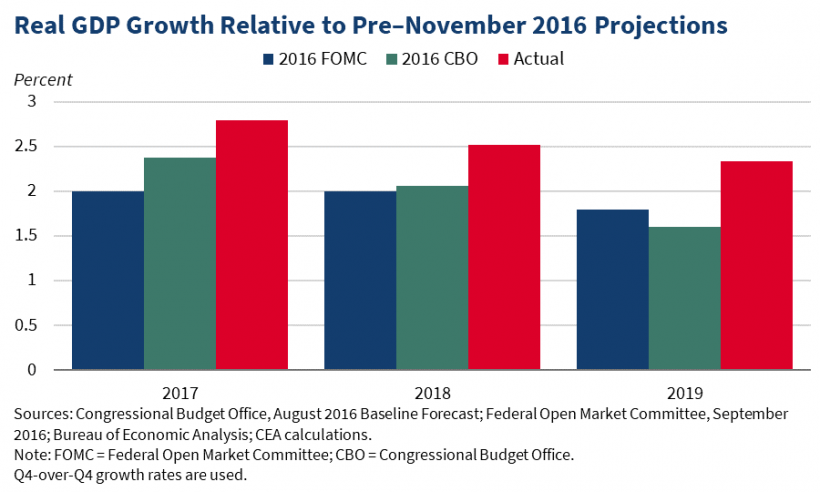

GDP growth in 2019 continues to exceed pre-election forecasts. For example, in its final projection before the 2016 election, the Congressional Budget Office (CBO) estimated that real GDP would grow at a 2.0 percent annual rate over the first 12 quarters of a new Administration. Instead, under President Trump, real GDP beat expectations and grew at a 2.5 percent annual rate from the election to the end of 2019—faster than the rate under President Obama’s expansion period.

Last year marked the third consecutive year that real GDP growth exceeded the final CBO and Federal Open Market Committee projections made before the 2016 election, as shown in the figure below. Because of economic growth surpassing expectations, real GDP at the end of 2019 is $260 billion—or 1.4 percent—higher than CBO’s projection.

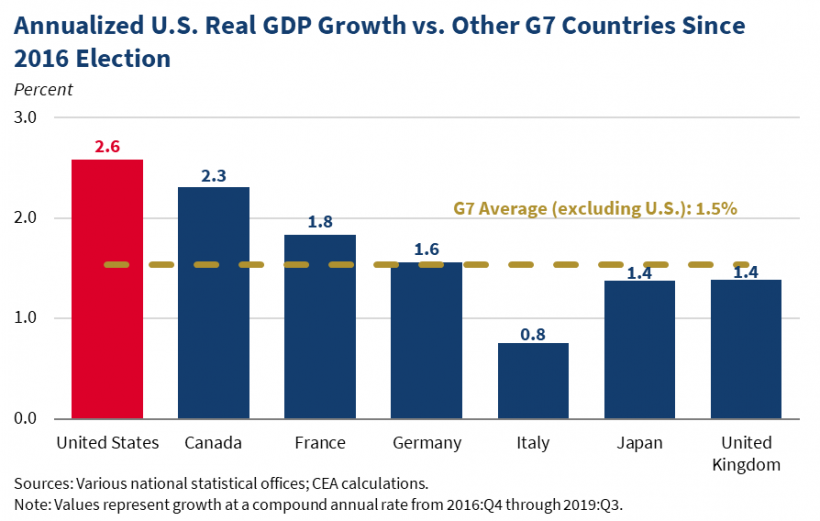

Despite headwinds from slower global growth and reduced aggregate demand, the American economy is stronger than other developed nations’ economies. As the figure below shows, from the beginning of the Trump Administration through the third quarter of 2019 (the latest comparable, available data), United States annualized GDP growth was more than a full percentage point above the other G7 countries’ average. The United States was one of only two G7 countries (the other being Japan, where projected growth was only 0.9 percent) that met the International Monetary Fund’s one-year-ahead growth projections for 2019.The other advanced countries saw large downward revisions. In particular, real GDP growth in Germany and the United Kingdom contracted in the second quarter of 2019. Major emerging market economies such as China and India also experienced slowdowns.

In the face of this global slowdown, American consumers continue driving the economy with robust spending growth. Real consumer spending grew 2.6 percent in the four quarters of 2019. Higher consumer spending accounted for roughly 80 percent of real GDP growth in 2019.

Consumers are spending more because their confidence is rising amidst historic labor market gains. The January reading of the Conference Board Consumer Confidence Index increased 3.4 points to 131.6, a 31 percent increase since the month before President Trump’s election. With a 50-year-low unemployment rate of 3.5 percent and 1 million more job openings than job seekers, the ratio of respondents who say jobs are “plentiful” compared to those who say jobs are “hard to get” is more than 4:1.

In December 2019, the National Association of Homebuilders/Wells Fargo Housing Market Index, which measures single-family homebuilders’ optimism, hit its highest level this century. Real residential investment rebound in the third and fourth quarters of 2019, growing at 4.6 percent and 5.8 percent annual rates, respectively. Strong housing starts data for December point to continued strength in residential investment into the beginning of 2020.

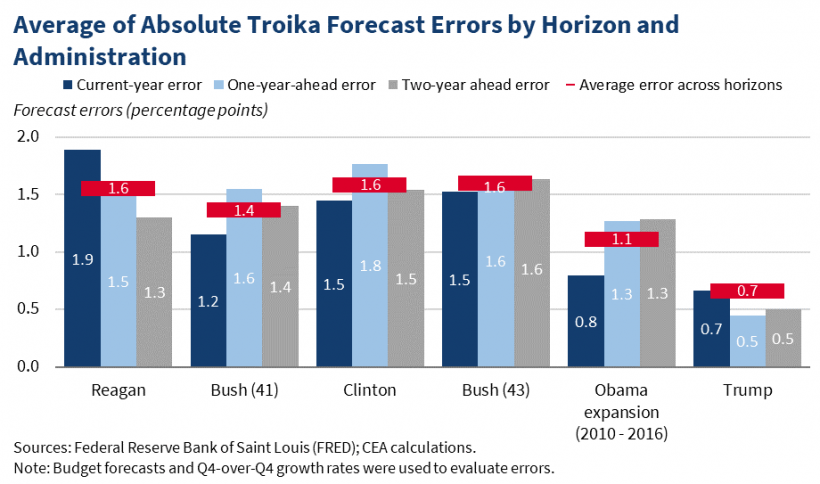

Though the data in the advance estimate set up the American economy for future gains, GDP growth over the four quarters of 2019 fell short of the Trump Administration’s forecast (Troika). Throughout 2019, unexpected events, including but not limited to production problems at Boeing and the strike at General Motors, along with a global growth slowdown, the lagging effects of tighter United States monetary policy, and the inevitable disruptions induced by trade renegotiations weighed down GDP growth. With President Trump signing the new USMCA deal yesterday and China and the United States reaching a Phase I agreement, much of the inevitable uncertainty implicit in trade renegotiations should fall. Additionally, the long-run benefits from improved trade deals should far outweigh the short-run strain on GDP. While the Administration’s GDP forecast missed in 2019 for the above reasons, as shown in the figure below, the average absolute errors of the ex-ante real GDP forecasts under the current Administration were the lowest among those of the last five administrations.

Today’s advance estimate of fourth quarter GDP shows that the American economy continued expanding at a healthy pace in 2019 despite strong headwinds from the global economy and expectations of growth moderating as the current record-long expansion matures. Along with strong growth in consumer spending and residential investment and the resolution of factors that held back GDP growth in 2019, these results provide reason to expect that the economy has further room to expand in 2020.