December 22 marks 2 years since President Donald J. Trump signed the Tax Cuts and Jobs Act (TCJA). TCJA’s pro-growth reforms of individual and corporate taxes were the largest tax cut in United States history. Additionally, since TCJA’s passage, United States multinational enterprises have repatriated $1 trillion in past overseas earnings that were previously invested abroad.

Prior to TCJA’s passage, CEA made a number of predictions about the legislation’s long-term effects on economic growth, business investment, wages, and the labor market. Though TCJA’s full economic benefits will require additional time to materialize, CEA’s projections have been largely borne out.

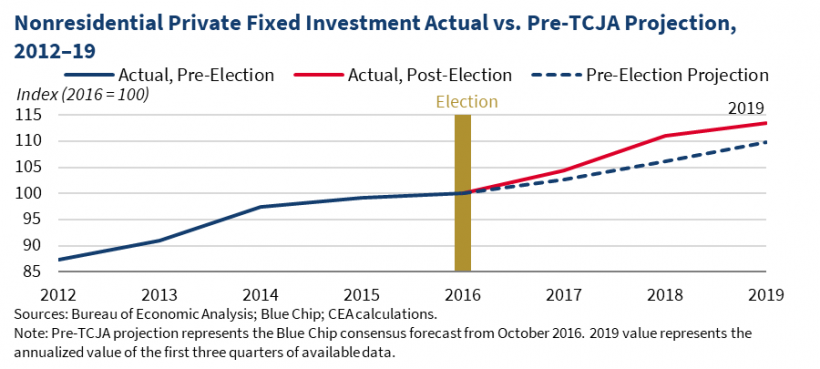

A major TCJA provision allows businesses to immediately and fully deduct the cost of new capital investments, enabling them to invest more in their operations. CEA predicted an initial increase in the investment growth rate during the transition to an elevated steady state.

Investment levels have been notably higher in the post-TCJA period than Blue Chip’s pre-TCJA projections from October 2016. In 2018, investment was 4.5 percent higher than the projections. In 2019, investment was 3.3 percent higher than the projections and the capital stock is on track to expand across each major asset class (equipment, structures, and intellectual property products).

Additionally, TCJA provided much needed tax relief for America’s small businesses by letting certain pass-through entities deduct 20 percent of their qualified business income. As a result, over 80 percent of small firms believe that TCJA had a significant impact on the economy and over 50 percent believe it had a positive effect on their business, according to the National Federation of Independent Business.

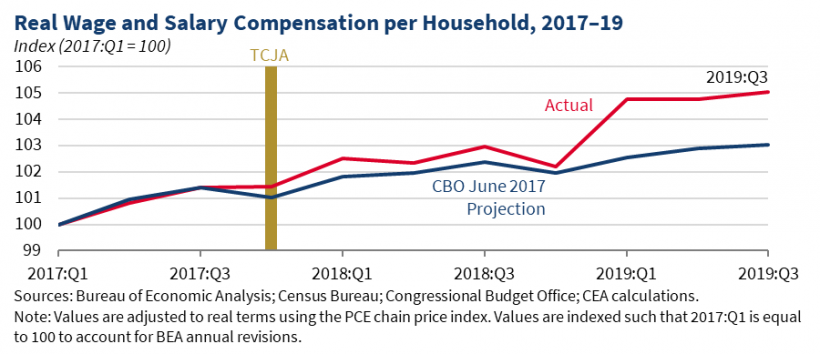

CEA estimated that a drop in the corporate tax rate would increase average United States household income by $4,000 over 5 or so years. The individual tax cuts, which were not included in CEA’s $4,000 forecast, also boosted disposable income for most households. For example, this year, TCJA’s doubling of the child tax credit will benefit 40 million American families, each receiving an average of over $2,200 dollars.

Altogether, real disposable personal income per household has risen by about $6,000 since TCJA was signed into law. Of that, our best estimate is that $1,500 to $2,900 (in real 2019 dollars) is due to the combination of TCJA’s individual and corporate tax reforms, meaning that a substantial portion of our estimated five-year income gains of $4,000 have already been realized.

The $1,500 lower-bound estimate is based on the divergence of real salary and wage compensation per household—a pre-tax measure that reflects corporate tax cuts, but not individual tax cuts—from the Congressional Budget Office’s (CBO) final pre-TCJA projections in June 2017 (shown in the figure below). The $2,900 upper-bound estimate is based on the divergence of real disposable personal income per household—a post-tax measure that incorporates the effects of both corporate and individual tax cuts—from the March 2017 Blue Chip projections.

By increasing businesses investment and worker earnings, TCJA has also supported today’s strong labor market. The United States unemployment rate continues to fall below pre-2016 election forecasts and reached 3.5 percent this year, the lowest rate in a half-century. A surge in labor demand means that for the first time since job openings data began to be collected, there are more job openings than unemployed people. Openings have now outpaced unemployed people for 20 straight months.

These labor market milestones were not expected before TCJA was signed into law. Actual post-TCJA cumulative nonfarm job gains of 4.7 million were nearly three times the 1.6 million gains estimated in the CBO’s final pre-TCJA projection. Furthermore, the robust job market is bringing Americans off the sidelines and into the labor market. The 1.6 million increase in the prime-age labor force in the 23 months after the passage of TCJA has more than offset the loss of 1.5 million prime-age workers under the Obama Administration’s entire expansion period.

In addition to keeping more of their earnings because of individual tax cuts, workers across all income groups are seeing their wages rise. Since TCJA was passed, wage growth for production and nonsupervisory employees (blue collar) has been higher than wage growth for nonproduction and supervisory employees (white collar), reversing the results from the Obama Administration’s expansion period.

Blue collar wages rose at a 3.0 percent annual rate from January 2017 through November 2019, much higher than the 2.4 percent annual rate from July 2009 through December 2016. Annual blue collar wage growth post-TCJA also exceeded annual white collar wage growth over the entirely of the current economic expansion.

Another major TCJA provision created Opportunity Zones to spur investment and increase investment and labor demand in economically-depressed areas. This change directly helps the 35 million Americans who live in the 8,764 communities designed as Opportunity Zones. The Opportunity Zones provision is a means-tested, supply-side policy to reduce poverty by enhancing self-sufficiency. There is evidence that Opportunity Zones, along with other reforms that lowered taxes on capital, are working as intended. Indeed, the lowest wage earners have seen the fastest nominal wage growth (10.6 percent) of any income group since TCJA was signed.

Two years after President Trump signed TCJA into law, economic growth continues exceeding expectations and the labor market continues breaking records on a monthly basis. By lowering the cost of capital, TCJA has raised business investment and personal income above pre-TCJA forecasts. While the full benefits of TCJA are yet to be realized, economic data show that the law has already improved the United States economy and Americans’ standard of living.