Real GDP grew above market expectations in the second quarter of 2019, according to the advance estimate released this morning from the Bureau of Economic Analysis (BEA). Growth was particularly strong in real consumer spending, which rose 4.3 percent at an annual rate in the second quarter of 2019. This increase is notably higher than the 2.5 percent pace set in the preceding four quarters.

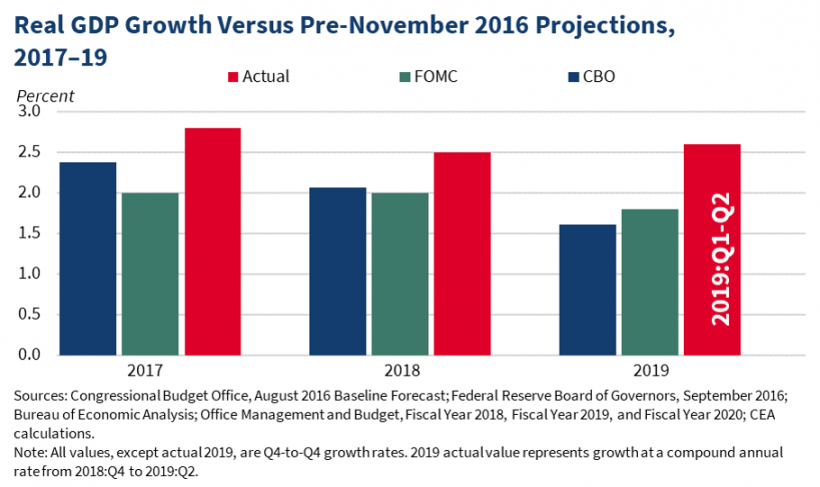

Though growth in the second quarter of 2019 is lower than in the first quarter, we estimate that the problems at Boeing subtracted 0.4 percentage point from second quarter annualized real growth. The sharp slowdown in aircraft shipments reduced equipment investment and exports, but were partially offset by an increase in aircraft inventory investment. Considering this issue, the strong growth set in the first quarter of 2019 of 3.1 percent and the 2.5 percent pace set in the second quarter—adjusting for Boeing’s safety problems—result in growth so far in 2019 of 2.8 percent at an annual rate. Not adjusting for Boeing’s safety problems, growth so far in 2019 of 2.6 percent at an annual rate far exceeds the growth projected by the final pre-2016 election forecasts of both the Congressional Budget Office (CBO) and Federal Open Market Committee (FOMC) for 2019 (see figure). The CBO projected growth of just 1.6 percent in 2019, while the FOMC projected real growth of just 1.8 percent on a fourth-quarter-over-fourth-quarter basis.

Evaluating the most persistent and well-measured components of real GDP, real private domestic final purchases (PDFP) typically provide a better signal for next quarter’s growth. In the second quarter of 2019, PDFP grew 3.2 percent at an annual rate, above the overall GDP growth. PDFP is the sum of consumer spending and fixed investment.

In addition to the advance estimate of GDP growth in the second quarter of 2019, BEA released revisions to growth in the first quarter of 2019. Real gross domestic income growth, which measures the income-side of output, was revised up in the first quarter of 2019, more than tripling from 1 percent to 3.2 percent. Most of the upward revision was accounted for by upwardly revised figures for wages and salaries as reported from the unemployment insurance tax system.